India Business Information

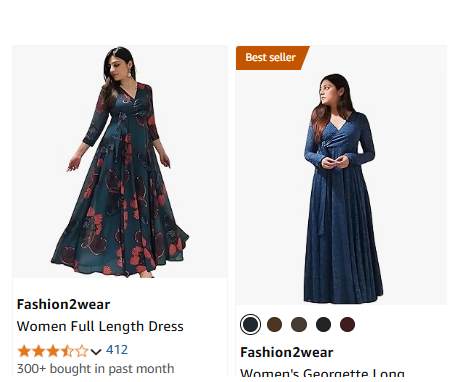

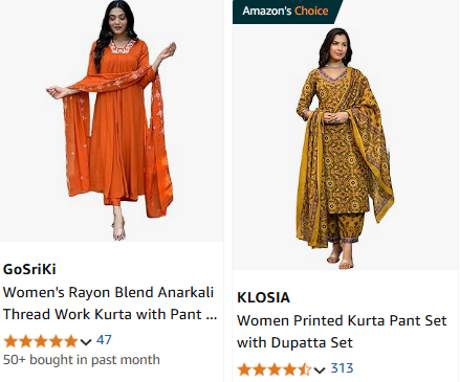

Online Shopping

Visitors: 1788

Apply SBI Credit Card Online

350 activation bonus Reward Points on first transaction of Rs 500 or more within 45 days of card issuance

Earn upto 10% Rewards on buying tickets through IRCTC App & website

Earn Rs 100 cashback on your first ATM cash withdrawal within 30 days of receiving the card

Earn 1 Reward Point on every Rs 125 spent (1 Reward Point = Re 1)

Save 1% transaction charges on train bookings

Earn upto 10% Rewards on buying tickets through IRCTC App & website

Earn Rs 100 cashback on your first ATM cash withdrawal within 30 days of receiving the card

Earn 1 Reward Point on every Rs 125 spent (1 Reward Point = Re 1)

Save 1% transaction charges on train bookings

SBI Credit Card Features

Buy tickets through irctc.co.in & IRCTC Mobile App (for Android only) for AC1, AC2, AC3 and AC CC and earn upto 10% Value Back as Reward PointsLink your IRCTC SBI Card loyalty number with your IRCTC login id to redeem your Reward Points on IRCTC Website and Mobile App

Save 1% transaction charges on railway ticket bookings on www.irctc.co.in

Enjoy 4 complimentary railway lounge access in a year in India (Max 1 per quarter)

1% Fuel charge waiver

SBI Card Fees & List of all charges

Joining Fees: Rs 500+GSTAnnual Fees: Rs 300+GST

Annual Fee waiver: On spends more than Rs 2,00,000 annually

SBI CARD - Documents Needed

ID proofAddress proof

Income proof

Valid PAN card

SBI Credit Card Eligibility Criteria

Required Age: 21-65 yearsEmployment status: Salaried or Self-Employed

Minimum Income: Rs 20,000 per month

Credit score: 650+

New to credit: Allowed only for Salaried

Credit card holders are preferred

No Delay Payments in last 12 months

Cardholder should be citizen of India or a Non-Resident Indian

Apply Now

SBI CASHBACK Credit Card - First Year Free

* Save Upto Rs. 60,000/- Annually

Popular Post(s)...

/Sports

/Online Shopping

/Online Shopping

/Online Shopping

/Sports

Menu

- IPL

- World University rankings 2022, 2023

- Weight Loss

- Website Monetization

- United States Free Business Directory

- Tech Support

- Study in US

- Study in United Kingdom

- Study in India

- Sports

- Pets Name

- Movie and Theatres

- London Business Directory

- Aadhaar Services

- Indian Food Recipes

- Home

- American Food Recipes

- Astrology

- Best Hits Of Madhuri Dixit

- Bollywood Celebrities

- Business India

- Corona News

- DTDC Courier Tracking

- Ecom Express Tracking

- Fully Funded UK Scholarships

- Hit Video Songs

- India Track Your Courier

- States-and-Capitals

- Tamilnadu-Business

- Currency Exchange

- Online Shopping

- Baby Names by Birth Star

( 5 ) by 1 User(s).

( 5 ) by 1 User(s).